Nov

03

Rate Watch Week of Nov. 2

Posted In: First Time Home Buyers, Mortgage & Finance

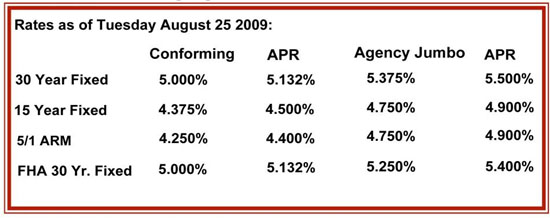

Rates moved up slightly again in the past week. Freddie Mac announced that for the week ending October 29, 30-year fixed rates averaged 5.03%, up from 5.00% the week before. The average for 15-year fixed rose to 4.46%. Adjustables were also up slightly with the average for one-year adjustables rising to 4.57% and five-year adjustables increasing to 4.42%. A year [...]